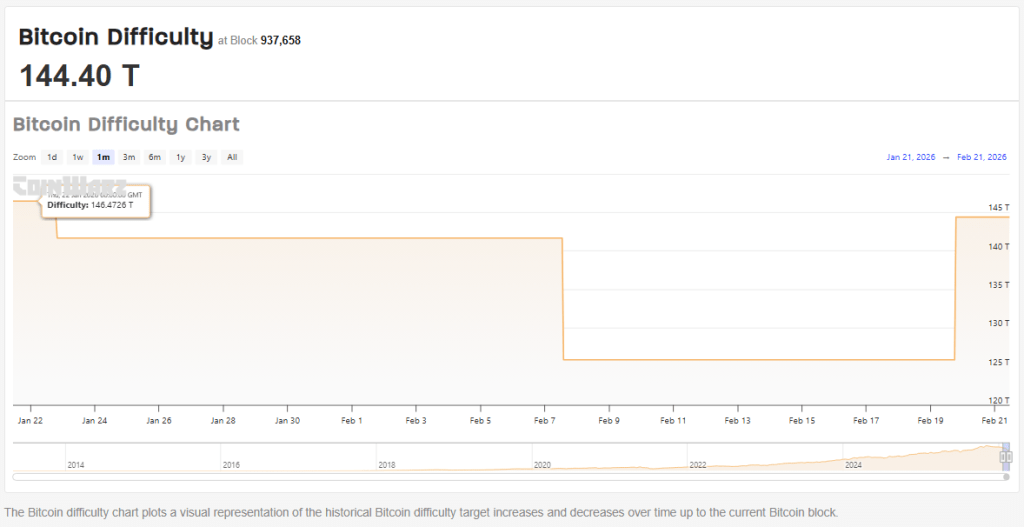

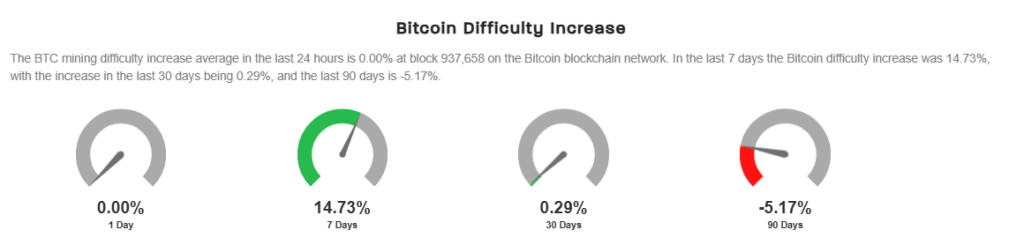

Bitcoin hashing power pushed the difficulty up about 15% to a little past 144 trillion on Friday, based on data from CoinWarz. That move reversed an earlier drop of 10% that followed widespread outages in parts of the US.

The numbers are blunt: machines went quiet during extreme weather, then came back online, and the protocol rebalanced itself.

Winter Outages And The Bounce Back

Foundry USA’s pool saw a dramatic swing in computing power, falling near 198 EH/s before climbing from roughly 400 EH/s. Reports say that many operators in affected regions shut down temporarily during the winter storms to protect equipment and help grids.

Some of the spaces that host miners coordinated with utilities. Power was conserved. Power was redirected.

Flexible Power Deals Changed The Game

Reports note that several miners did more than pause operations. LM Funding America reported curtailing machines and sending contracted power back to the grid, pocketing curtailment payments that helped offset lost mining time.

Canaan Inc. also said its US sites took part in demand response moves with local partners. These arrangements are part of why many facilities can afford to go offline when the grid needs relief, then restart when conditions improve.

Bitcoin’s difficulty is designed to reset every 2,016 blocks to hold average block times close to the 10-minute target. When more hash power returns, the algorithm raises difficulty. That makes the network harder to attack and raises the work needed to win a block reward.

For miners, higher difficulty reduces the Bitcoin earned per unit of compute, squeezing margins for outfits with older rigs or higher electricity bills.

Price Moves Stay Tied To HeadlinesBitcoin traded near $68,000 as markets reacted to rising geopolitical strain, especially between the US and Iran. Trading has felt cautious. Volume is lighter. Prices have bounced and then stalled on headline-driven flows, showing that investor mood still swings with global news.

At the same time, network metrics kept shifting under the surface — a reminder that technical and macro drivers can pull in different directions.

The US now supplies a big chunk of global hash power, according to Cambridge Centre for Alternative Finance. That means regional events, weather, and grid policies in the US matter a lot to global security and miner economics.

Some firms have begun to treat mining as a flexible load that can stabilize grids during stress, creating new income streams beyond pure block rewards.

Politics And Market ToneComments from politicians and geopolitical moves add friction. Mentions of US President Donald Trump in recent headlines have been tied to broader market nervousness; geopolitics can pull risk appetite downward and keep crypto prices range-bound.

The difficulty rebound itself didn’t spark a big price jump. Instead, it reinforced a simple truth: the protocol handled the shock, but miners felt the squeeze.

Featured image from Pexels, chart from TradingView

2 hours ago

4

2 hours ago

4

English (US) ·

English (US) ·